In 2017, the accounting understated the income of enterprise income tax by more than 5 million yuan, the enterprise income tax was collected through audit, and the cost was not accrued in 17 years

.

The construction unit submits the measurement report to the construction unit in March, pays the progress payment in April, and the construction unit issues the invoice of 10% or 9%

.

When VAT cannot be deducted, should we simply ask the other party to issue a general invoice instead of a special invoice, or issue a special invoice first and then transfer it out? The voice explanation is as follows: welcome to forward, welcome to like, welcome to watch!.

.

If there is no tax liability after receiving the advance payment of the project, do you need to pay part of the value-added tax in advance? In the same case, do you need to collect the rental fee in advance? Do you need to collect the sales house money in advance? Do you have tax liability? Do you need to pay the tax in advance? Is the special ticket obtained in March and certified in April applicable to the policy of additional deduction? 4

.

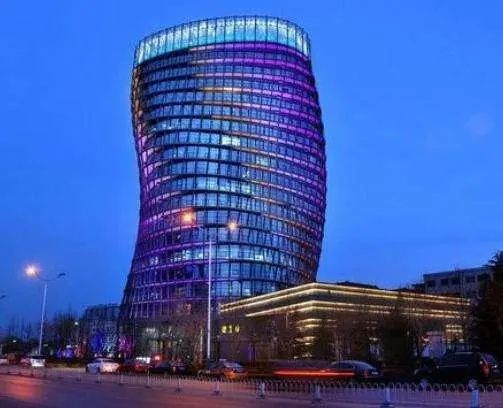

All audio and video (PPT) information of this course can be found by the following figure: This course explains the six fiscal and tax issues concerned by netizens from March 31 to April 6, 2019: 1

.

In addition, for the 10% general contract signed before April 1, how can the unit price be adjusted after April 1 Reasonable? 2

.

Can you make up for the loss in 2018 in 2019? 5

.

Now if the cost invoice can be provided, can it be adjusted? 6

.

The enterprise income tax in 2018 is verified and collected, with annual loss, and the enterprise income tax in 2019 It’s collection by audit

.