Fixing Socket Angular End Nail Plate

57) 8.

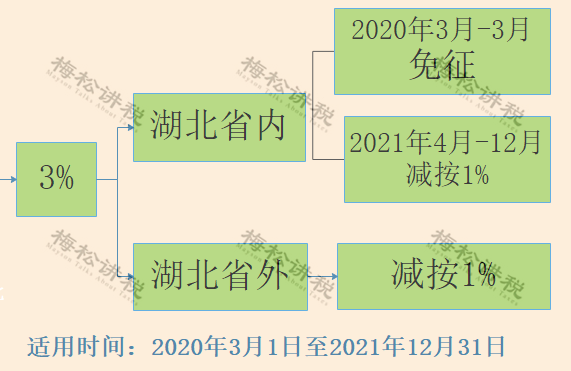

Although the policy has expired, it has been determined to extend it again! (4) .

Veterinary drug trading enterprises sell veterinary biological products.

(General Administration Announcement No.

Wash wool and cashmere.

If the policy of levying value-added tax at the rate of 3% and 2% in the simple method is applicable to the sale of fixed assets used by themselves, the tax reduction can be waived, the value-added tax can be paid at the rate of 3% in the simple method, and a special invoice for value-added tax can be issued.

(Cai Shui [2009] No.

Print it out and learn it immediately! Note: from January 1, 2022, small-scale taxpayers will be temporarily reduced by 1%.

(CS [2009] No.

12.

Public transport services.

Cooked aquatic products and cans of various aquatic products.

Sell self-produced sand, soil and stone materials for construction and production of building materials.

90 of 2015) 14.

Sell self-produced bricks, tiles and lime (excluding clay solid bricks and tiles) continuously produced from sand, soil, stone or other minerals mined by ourselves.

(Guo Shui Han [2009] No.

8.

20) 11.

2.

456, Announcement No.

15.

Daily sanitary drugs (such as sanitary insecticide, insect repellent, mosquito repellent, mosquito repellent incense, etc.) for various types of packaging used in human daily life.

Sawn timber, canned bamboo shoots.

After the official document is issued, the official document shall prevail.

9, CS [2014] No.

57) 5.

3.

4.

(CS [2009] No.

Provisions on matters related to the pilot of replacing business tax with value-added tax (Cai Shui [2016] No.

Consignment stores sell consignment items (including items consigned by individual residents).

Services provided by recognized animation enterprises for the development of animation products and the transfer of animation copyright in China..

the 3% levy rate is reduced by 0.5%.

9, CS [2014] No.

9, CS [2014] No.

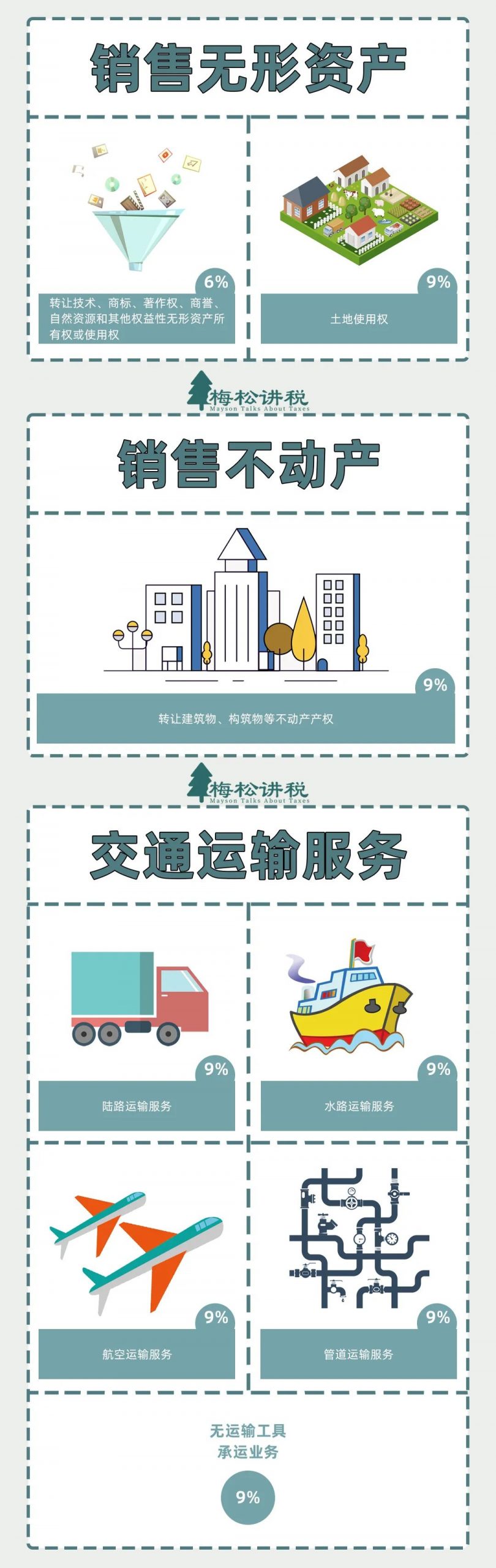

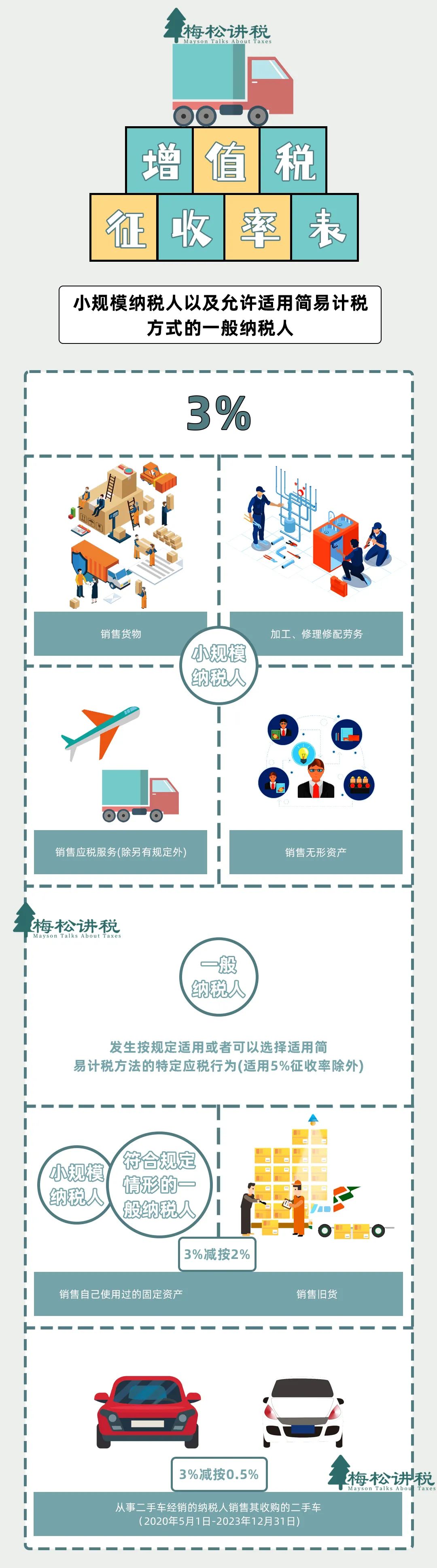

At present, there are four levels of value-added tax collection rate, 0.5%, 1%, 3% and 5%, generally 3%, unless otherwise stipulated by the Ministry of Finance and the State Administration of taxation.

Plasma collection stations sell human blood for non clinical use.

57) 2.

Small scale taxpayers of value-added tax and ordinary taxpayers who use simple tax calculation (see Annex) use the collection rate when calculating taxes.

5.

57) 7.

11.

Feed additives.

Power producers of photovoltaic power generation projects sell power products.

(CS [2009] No.

Goods with a tax rate of less than 13% are easy to be confused with agricultural products and other goods with a tax rate of 9%.

36, annex 2) 15.

Pawnbroking sells dead pawn goods.

Small scale taxpayers who sell goods other than fixed assets that they have used shall be subject to value-added tax at a rate of 3%.

57) 3.

14.

Taxpayers who sell their used fixed assets and apply the simple method of levying value-added tax at the rate of 3% minus 2% can give up the tax reduction, pay value-added tax at the rate of 3% according to the simple method, and issue special invoices for value-added tax.

6.

Including ferry, bus passenger transport, subway, urban light rail, taxi, long-distance passenger transport and shuttle bus.

Jianzhong001 value added tax has changed again! The tax bureau just informed! The latest thinking map of value-added tax rate in 2022 is coming.

9, CS [2014] No.

4.

57) 4.

Sell self-produced tap water.

(Announcement No.

Quick frozen food, instant noodles, non-staple food and all kinds of cooked food processed with grain as raw materials, corn pulp, corn skin, corn fiber (also known as spray corn skin) and corn gluten powder.

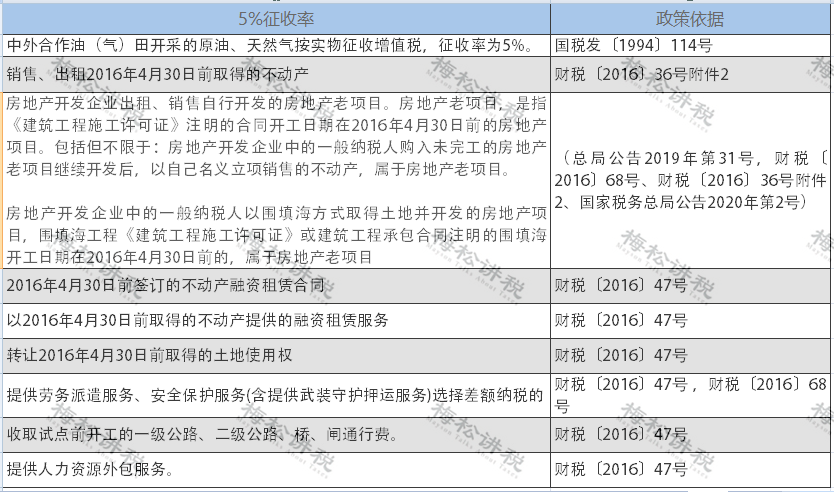

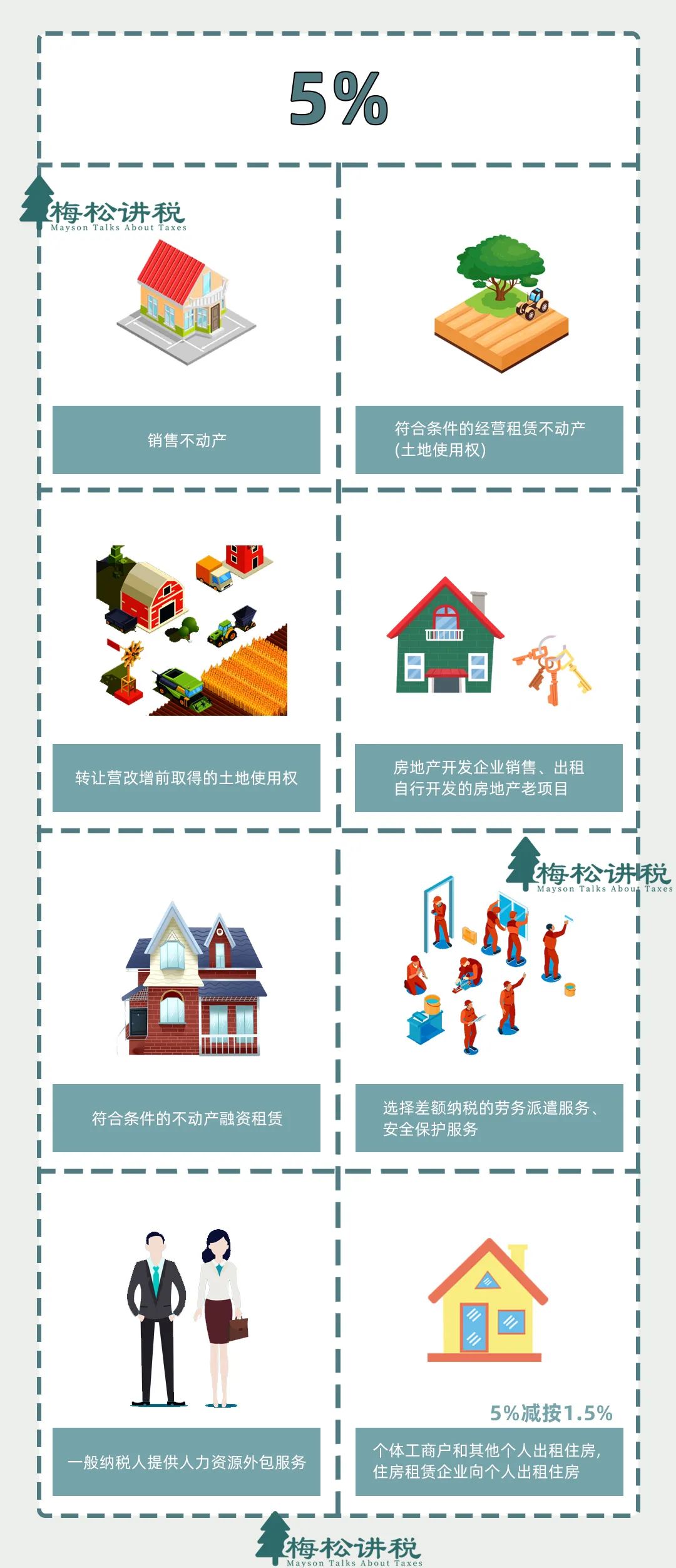

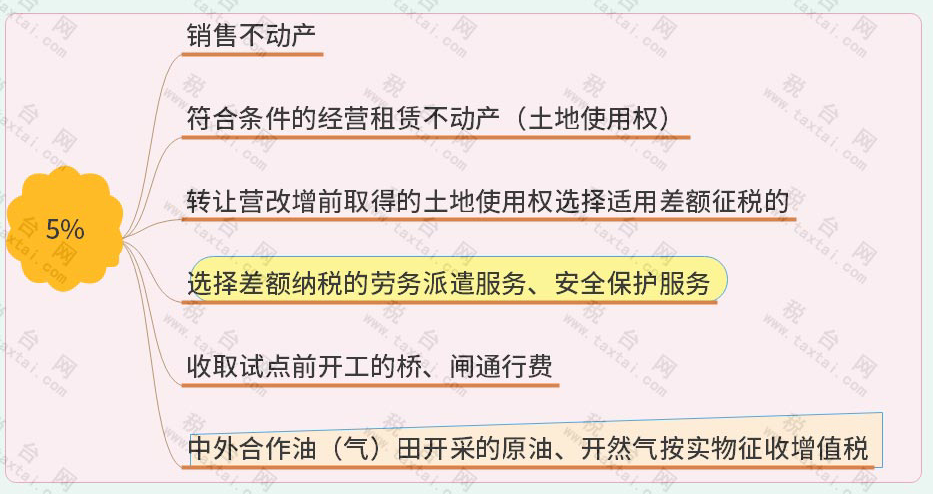

2、 General taxpayers (I) 5% levy rate: (II) 3% levy rate 1.

32 of 2014) 12.

1.

Chinese patent medicine.

9, CS [2014] No.

9, Cai Shui [2014] No.

Sell self-produced commercial concrete (only cement concrete produced with cement as raw material).

(CS [2009] No.

1、 Small scale taxpayers (I), 5% levy rate (II), 3% levy rate (III), 3% levy rate reduced by 1%.

All kinds of canned meat and cooked meat products.

10.

Sell the power produced by self-produced small hydropower units at and below the county level.

Yogurt, cheese, cream, prepared milk.

(General Administration announcement [2012] No.

7.

Canned eggs of all kinds.

36 of the State Administration of Taxation in 2014) 10.

(CS [2009] No.

9.

57) 6.

8 of 2016 of the State Administration of Taxation) 13.

Sell self-produced biological products made of microorganisms, microbial metabolites, animal toxins, human or animal blood or tissues.

9, CS [2014] No.

2.

Redried tobacco leaves baked in a professional Redrying Factory.

Canned vegetables.

All kinds of canned fruits, preserved fruits, preserves, fried nuts, nuts, ground horticultural plants (such as pepper, pepper powder, etc.).

Taxpayers engaged in second-hand car distribution business sell their purchased second-hand cars in accordance with the following provisions: (V) the 3% levy rate is reduced by 2% Small scale taxpayers (except other individuals, the same below) who sell their used fixed assets will be subject to value-added tax at a reduced rate of 2%.

(CS [2009] No.

5 the tax rate of value-added tax is easy to be confused with 9% tax rate goods such as agricultural products.

Pharmaceutical trading enterprises sell biological products.

Machinery, agricultural vehicles, three wheeled trucks, motor fishing boats, deforestation machinery, skidding machinery and agricultural machinery parts that use agricultural and sideline products as raw materials to process industrial products.

9, CS [2014] No.

(General Administration Announcement No.

The refined tea produced by agricultural producers through screening, air selection, picking, fragment, drying, uniform stacking and other processes, as well as the tea and tea drinks mixed with various drugs.

13.

57) 9.

(CS [2009] No.