Clawson’s colleagues said that he had been in Europe for a month since mid July.

Court documents contain allegations that have not been substantiated by the court.

in London It may be just one of many developers facing financial problems, including delay in construction period and rising construction costs.

Mike clapson and Perry sempecos are the two principals of the project.

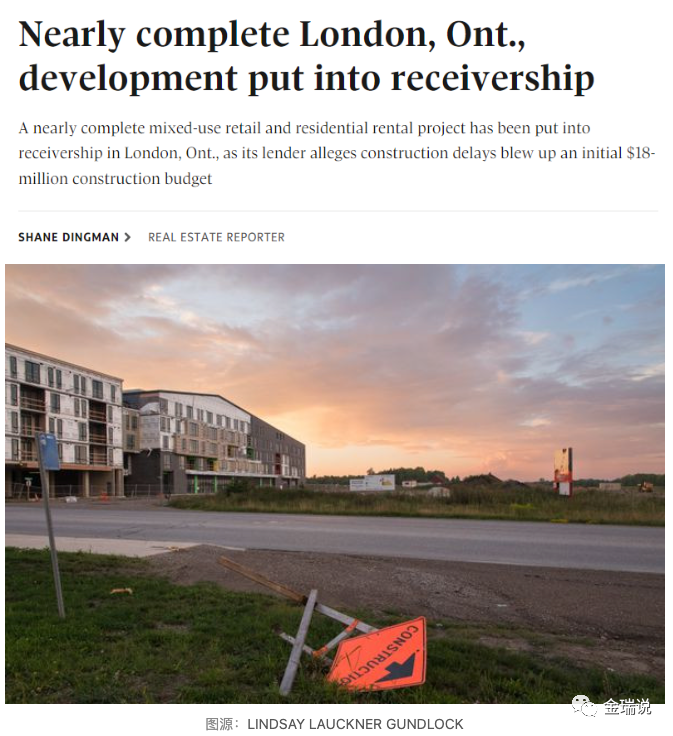

A mixed use retail and rental residential project near completion in London, Ontario, has now been put into bankruptcy proceedings.

This is very fast and a large amount of money.

In 2020, clapson and sempecos obtained loans from Marshall Zehr to finance the construction of phase I of the project.

The financial challenges brought by the project delay also affect subcontractors, because their business is also affected by the same labor force And the pressure of supply problems..

“We are in such a stalemate, either the cost will drop, or the income will increase…

Subsequently, the debtor allegedly attempted to sell the project to a third party and shared an expired sale and purchase agreement with Marshall Zehr.

In June, all construction sites were shut down.

Marshall Zehr will convert the debt into equity ownership of the project, or some form of sale arrangement to repay the loan.

In 2019, clayson purchased a piece of land from Peter sergautis, a local landlord.

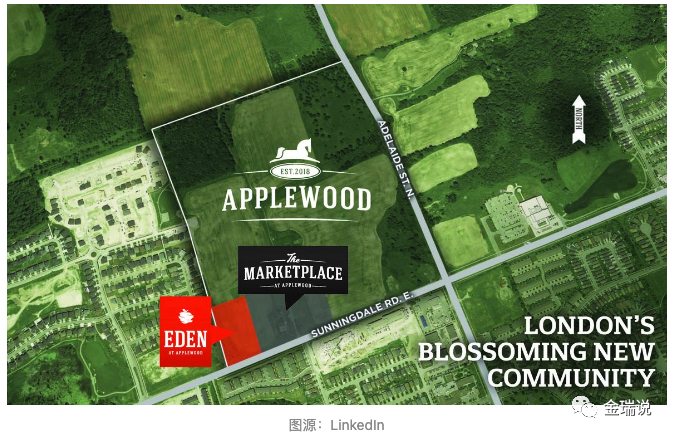

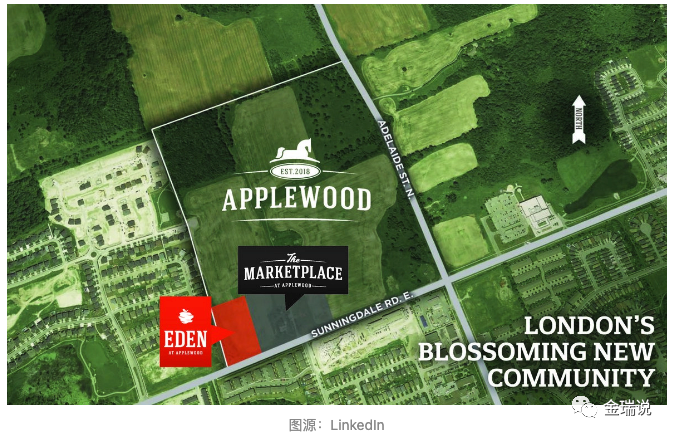

This project, applewood marketplace, is located in the north end of London and used to be a farmland.

According to the report, Marshall zehrgroup Inc According to the documents submitted to the court, applewood owed the company more than $58 million, and the interest on these debts exceeded $36000 per day.

What they see is that people make money from real estate.

Over the years, the growing income has covered up many rash mistakes.” Although the demand for housing is as hot as ever, the growth of construction costs has outpaced the growth of income.

According to Altus group, a real estate research and data company, about 60% of residential and commercial projects are facing delays, about one-third of the original plan.

Or the project will not start.

Now that the tide of the market has receded, some builders will run aground.

The second phase is larger in scale and plans to accommodate more than 460 apartments.

appointed a receiver to oversee the resolution of the company’s bankruptcy.

Take a 30 storey building in Greater Toronto as an example: every month of delay, it will easily burn $500000 to $800000.

The contractor also submitted a lien application for $8 million of unpaid work.

In May this year, the first of 46 contractors to set up liens for unpaid work appeared on the property ownership.

Cecil Hayes, chief operating officer of Marshall Zehr, said in a written statement that the troubled project started to go wrong on April 4, 2022, when the company stopped paying the loan interest.

There are 50 companies participating in this project, so once delayed, they will face a lot of litigation trouble.” Schoonjans said that one of the challenges in defining delays and their potential costs is that it is possible that the project schedule is never realistic and the cost is underestimated from the beginning.

Peter berczi, chief executive officer of Marshall Zehr, said: “it is not appropriate for Marshall Zehr to comment more on the bankruptcy administration.” According to the report, in the construction industry, time is money, and delays in construction may eventually deplete a company’s cash reserves.

Sempecos declined to comment and clayson could not be reached.

Clapson has always been a London Custom House Builder, and sempecos is a family business in real estate and commercial development.

Just when the first phase of the project was delayed, applewood began to prepare the second phase.

This is a five storey building, including 107 rental apartments and retail space on the first floor.

Sergautis has been planning to build a larger plot with the same applewood brand since the early 1980s, and began to package and sell part of the land.

David schoonjans, senior director of cost and project management at Altus group, said: “interest is just the tip of the iceberg and involves more than that.” “The project costs include crane leasing, management and subcontractors.

According to the lender of the project, the construction delay caused the initial budget of $18 million to burst, and dozens of contractors filed claims for several million yuan of unpaid work.

According to global mail, applewood marketplace Inc.

What will happen next will be some form of arrangement.

On June 3, Marshall Zehr sent applewood a request letter and a notice of intent to enforce the mortgage (nites).

In March this year, Greg zayadi, President of Rennie group in Vancouver, said that the construction cost in Greater Vancouver has increased so dramatically that it has exceeded the land price and become the biggest unknown factor for developers.

He said: “when the market rises, everyone sees huge profits…

Sergautis has no continuous financial relationship with clapson or its partners, and said that he hopes that all parties can reach an agreement to complete the first phase of the development project he dreams of.

On August 3, Ernst & Young Inc.