The boss is scolding Xiao Wang again

.

Xiao Wang has been a construction accountant for five years, but after five years, he has been unable to do his job

.

His salary has increased from 3000 to 4000

.

With his marriage, birth, mortgage and car loan pressure, he thought about how to get a raise

.

Later, he found the boss

.

I have been working here for five years

.

Why don’t he give me a promotion and raise? The boss ignored him

.

Xiao Wang was also very upset and didn’t know what to do

.

Suddenly one day, the boss gave him a piece of paper with 10 questions on it

.

The boss said, if you answer all the 10 questions, I will give you a promotion and a raise

.

Half an hour later, when the boss saw the answer written by Xiao Wang, he was so angry that he scolded Xiao Wang

.

That’s all

.

Do you want me to give you a promotion and a raise? Even if you don’t know that in five years, I won’t give you a promotion or a raise

.

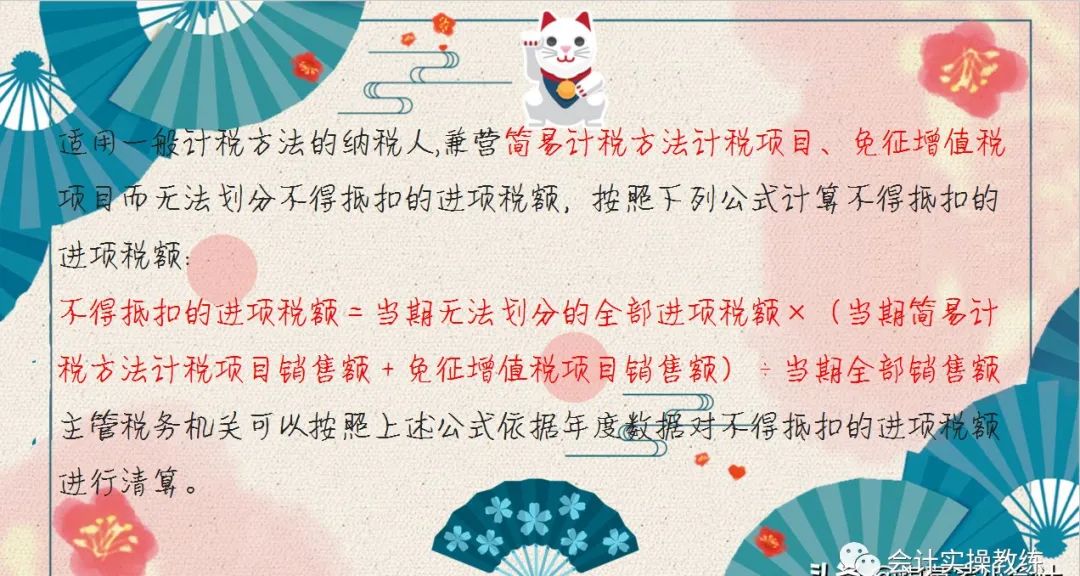

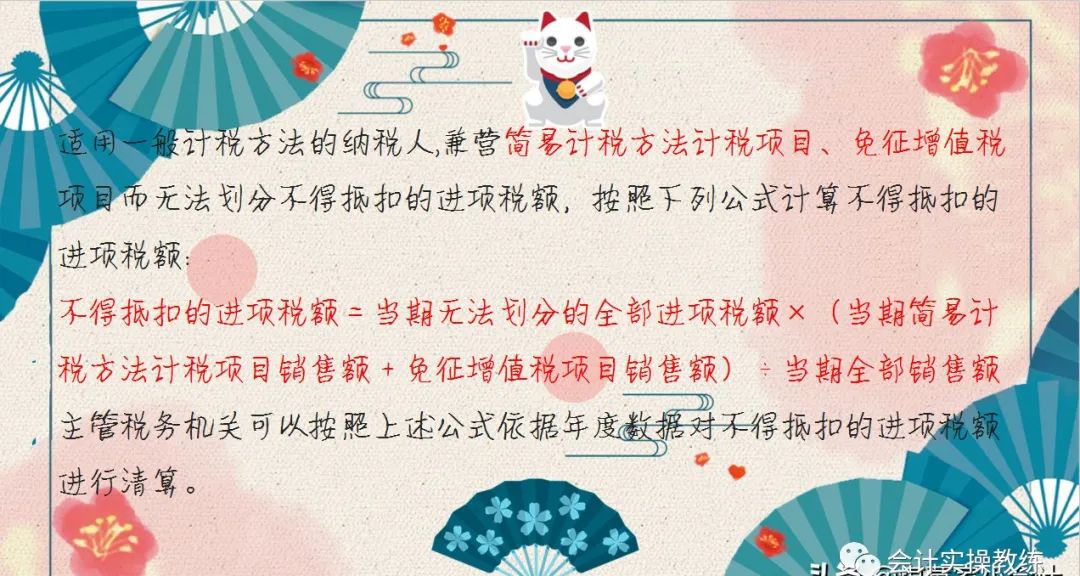

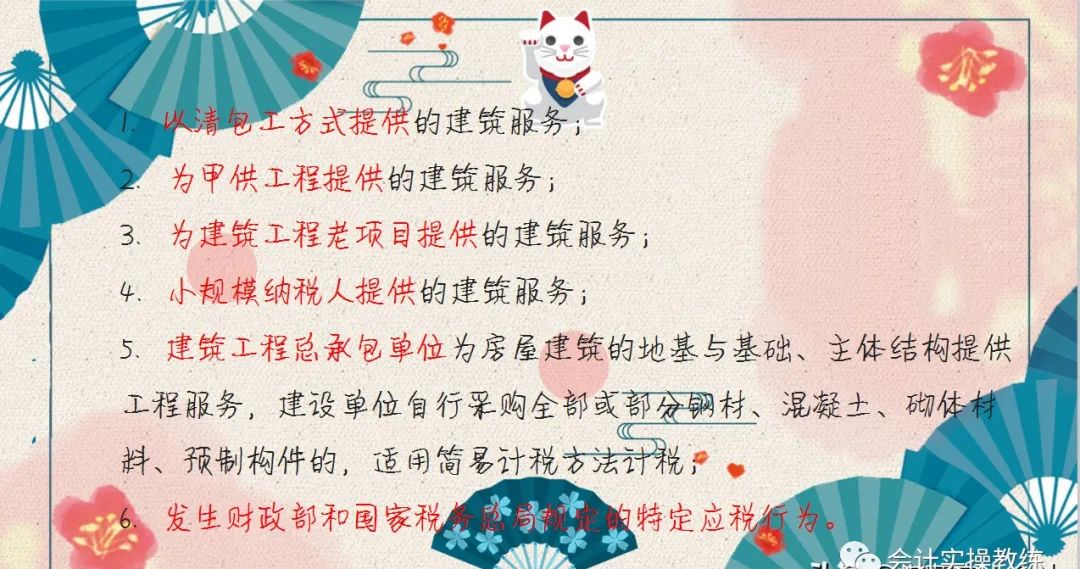

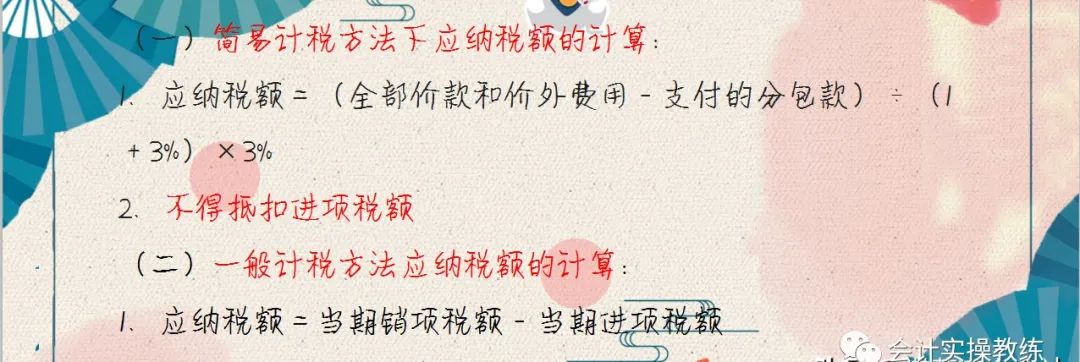

Under what circumstances is the “simple” tax method applicable to construction services? How to calculate the value-added tax of construction services under different tax calculation methods? If the company has a large amount of input tax allowance, will it continue to pay the value-added tax of construction projects in advance? If a general taxpayer provides construction services across provinces (autonomous regions, municipalities directly under the central government or cities separately listed in the state plan) or sells or rents the real estate that is not in the same province (autonomous regions, municipalities directly under the central government or cities separately listed in the state plan) as the place where the institution is located, and the calculated tax payable is less than the prepaid tax, and the difference is large, the State Administration of Taxation shall notify the construction department The provincial tax authorities in the place where the service takes place or where the real estate is located shall suspend the prepayment of VAT for a certain period of time

.

The company has both general tax items and simple tax items

.

How can input tax be deducted? Do you need to file tax when choosing simple tax method for construction services? 4

.

Taxpayers who provide construction services across counties (cities) and apply or choose to apply the simple tax calculation method should file with the local competent state tax authority according to the above provisions, and there is no need to file with the local competent state tax authority where construction services occur

.

How to confirm the time of tax liability of construction service value added tax? After undertaking construction business, does it belong to “affiliation” to other enterprises in the group? Is the sale of self-made goods, construction and installation services at the same time a mixed sale? Does the input tax of temporary houses constructed on the construction site need to be deducted in two years? Is it “labor service” or “salary” to pay migrant workers’ wages on the construction site?.

.