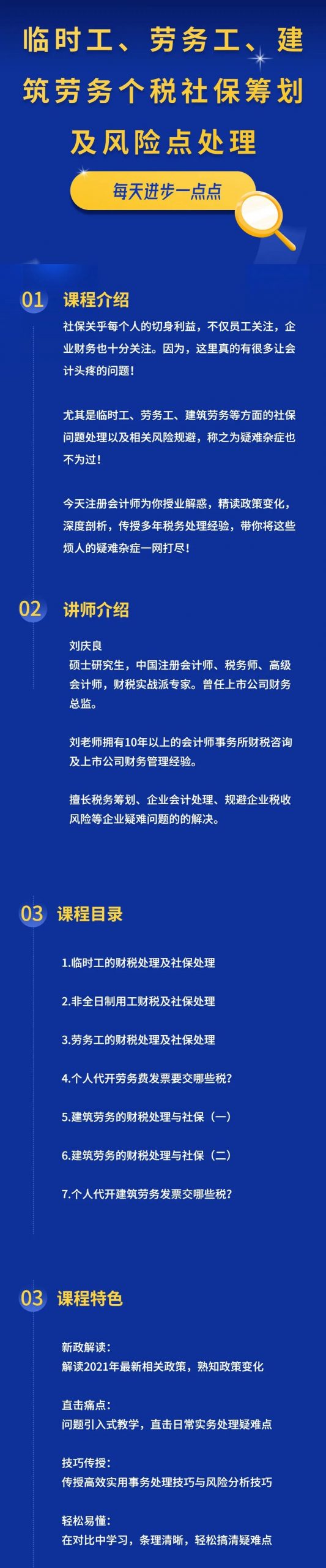

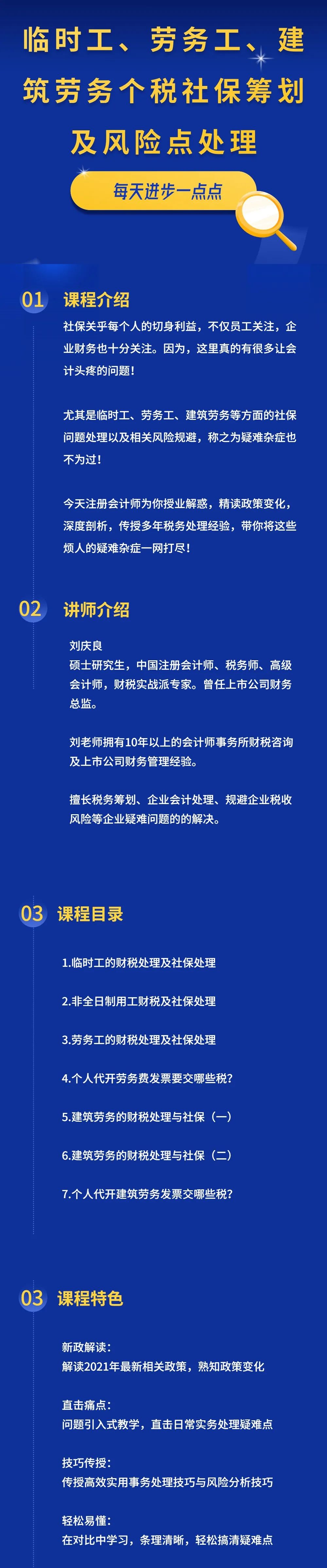

Social security concerns everyone’s vital interests, not only employees but also corporate finance

.

Because there are really many problems that make accountants headache! In particular, it is not too much to call it difficult and miscellaneous diseases to deal with social security problems and avoid relevant risks in terms of temporary workers, labor workers and construction services! For example, [1] what are the explicit provisions on the salary, social security and individual income tax of temporary workers? How to deal with finance and taxation【 2】 What are the explicit provisions on the salary, social security and individual income tax of part-time employment? How to deal with finance and taxation【 3】 What are the risks of labor employment? How to deal with the value-added tax and enterprise income tax involved【 4】 What taxes do individuals need to pay to issue labor invoices on behalf of others【 5】 How to deal with the social security and taxes of construction labor companies If your company also has the problems mentioned above, I recommend you to learn the following courses today 👇 The knowledge points of this course are rich in content and highly practical

.

The teacher’s lectures are vivid and humorous

.

After learning, they can be used for work! Now?

.