When ordinary taxpayers adopt the general tax calculation method, the tax rate of 9% is applicable.

When prepayment of tax is required, a collection rate of 2% / 3% may be used.

If the enterprise does not have a complex organizational structure, you can see whether the enterprise can apply simple collection to solve the problem of input.

Enterprises need to calculate their own tax burden rate according to the actual upstream and downstream conditions to see if there is room for further optimization.

See whether the enterprise has applicable preferential policies.

The key is how to make good use of these policies according to their own situation, so as to reduce the tax burden more vigorously.

The VAT rate involved in the construction industry can be divided into tax rate and collection rate.

2.

③ Department of housing and urban rural development: from now on, super grade and general contracting first-class enterprises can separate their low-grade general contracting qualification to a wholly-owned subsidiary in the province! ④ EPC bidding has new regulations! ⑤ EOD mode is on fire! How to finance? How to land? ⑥ Warm tips for 2022 online live course plan: if you like this article, please share it with your circle of friends for mutual benefit! In construction projects, we may encounter more complex tax rates.

And in principle, it shall not be changed within 36 months.

(1) Tax rate of construction industry: the VAT rate used by ordinary taxpayers when they adopt the general tax calculation rules is the tax rate.

1.

For construction services, the tax rate applicable to general taxpayers is 9%.

For example, if general taxpayers provide installation services while selling machinery and equipment, the installation service can be selected according to the project provided by Party A, and the simple tax collection rate is 3%.

3% tax rate strictly speaking, this 3% cannot be called tax rate, but should be called collection rate, because the basic tax rate of value-added tax does not have this level.

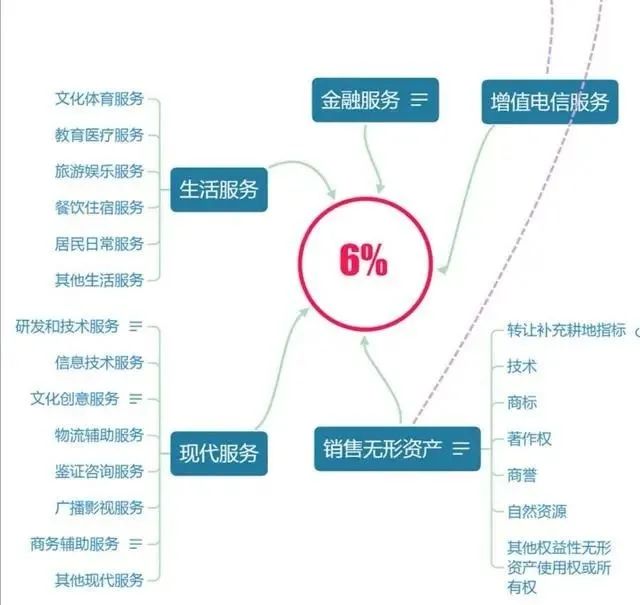

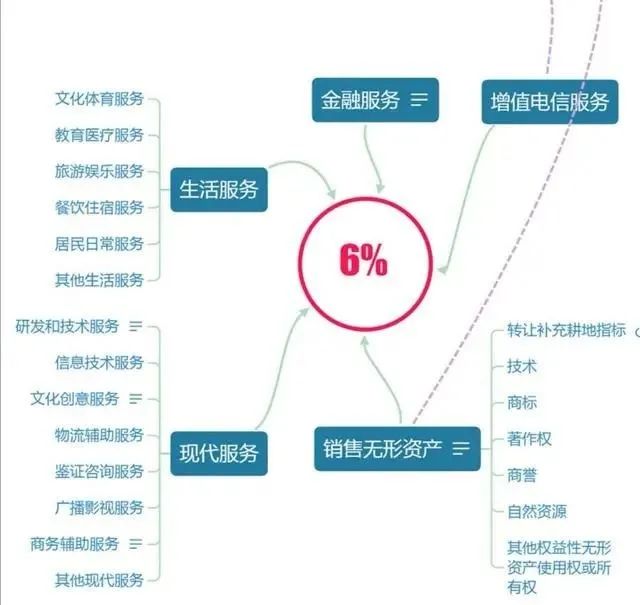

For example, if we need to provide engineering design or engineering survey and exploration services, or we need to provide engineering cost assurance services, these belong to the scope of modern services, and the tax rate of 6% is applicable.

Simple collection can be adopted for qualified general taxpayers.

This is not the focus of Lao Zhou’s answer.

At this time, if small-scale suppliers are selected, obtaining invoices with a collection rate of 3% will reduce the corresponding input.

Understand the special situation.

Calculate the tax according to the actual situation.

Taxpayers should judge whether the levy rate is applicable according to their own situation.

It is necessary to understand the basic tax rate, and then calculate it in combination with the actual situation of the enterprise to see if there is room for improvement, including applying for simple collection and other methods, so as to optimize the tax burden of the enterprise.

Special circumstances are not distinguished.

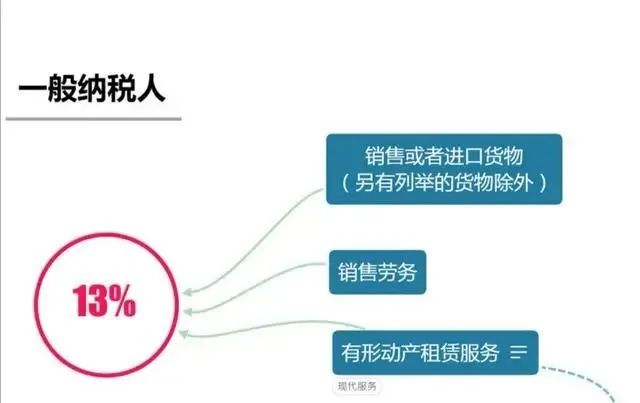

This tax rate is applicable to tangible movable property leasing services.

At the same time, it should also be noted that after the simple collection is selected, the input of general taxpayers can no longer be deducted.

Is the design institute ready to sell itself? ② The most complete data list from commencement to completion.

As we all know, this small-scale taxpayer can apply the 3% levy rate.

2.

For example, if small-scale taxpayers provide construction services, the levy rate of 3% may apply.

(2) Prepayment of tax involves the occurrence of construction services in different places.

1、 How to distinguish the tax rate of the construction industry 1 Distinguish the VAT rate and collection rate.

(2) Collection rate of construction industry: when simple tax calculation is adopted, the applicable value-added tax rate is the collection rate.

2、 Problems caused by complex tax rates in construction services in practice, because the tax rates in the construction industry are very complex, if they are not clearly distinguished, it will cause some problems.

Applicable business refers to construction services.

Let’s talk about the tax rates of 3%, 6%, 9% and 13% in your topic, and how to apply the tax rate.

Without distinguishing between special circumstances, there may be no choice of simple collection.

For example, the construction services provided by the way of clearing and contracting, and the construction services provided for the project provided by Party A.

In practice, taxpayers should distinguish between different businesses.

To distinguish these tax rates, we can first understand their background and meaning, and then combine them with specific business.

3、 Coping strategies combined with the actual situation of the enterprise 1 Understand the basic tax rate and combine with the enterprise situation.

In fact, it is not difficult to distinguish the value-added tax rate of construction projects.

Distinguish specific businesses.

Therefore, it is necessary to clarify the relevant tax rate at this time.

Or although it is a general taxpayer of construction services, but the simple collection can be applied according to the regulations, the collection rate of 3% is also adopted.

Including the construction, repair and decoration of various buildings, structures and their ancillary facilities, the installation of lines, pipelines, equipment and facilities, and other engineering operations.

3.

First understand the basic tax rate and collection rate, and then combine with the actual situation of the enterprise to see what kinds of tax rates are involved in the enterprise, 13%, 9% or 6%.

3.

When providing construction services, in addition to the tax rate of the construction industry, it may also involve the purchase of goods or tangible movable property services, or some other auxiliary services.

The tax rate collection rate is not clear.

Generally speaking, the value-added tax rate involved in the construction industry is relatively complex.

(1) The corresponding tax rate for selling goods or providing taxable services is 13%.

Let’s focus on the situation where ordinary taxpayers apply the 3% levy rate..

(1) General taxpayers adopt simple collection.

Some special situations may also be involved in construction services.

General taxpayers in the construction industry can apply simple collection under certain circumstances.

2.

Different businesses involve different tax rates.

For example, construction services may involve the purchase of raw materials or the provision of processing, repair and replacement services.

Enterprises need to calculate the tax according to their own situation, and then choose.

(2) The tax rate for modern services is 6%.

Including engineering services, installation services, repair services, decoration services and other construction services.