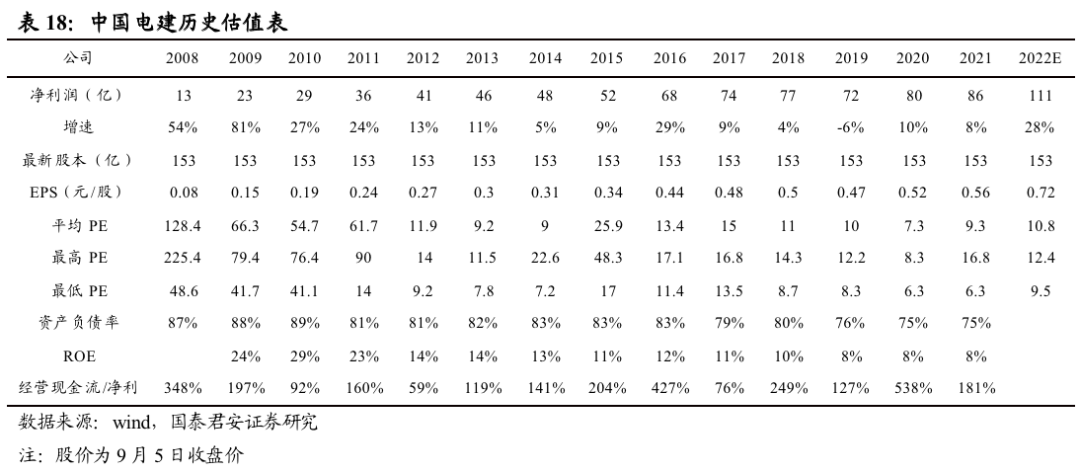

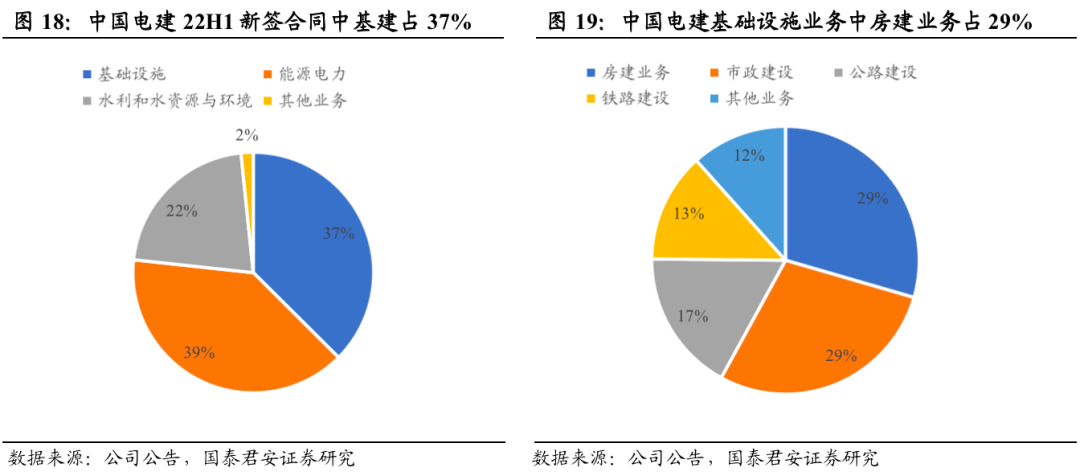

(3) Since July 12, a series of new track reports have been launched, including 69 pages of “new energy power / BIPV / new energy vehicles / intelligent driving and other new infrastructure recommended seven directions”, 37 pages of “heterojunction perovskite battery Hangxiao steel structure investment at the end of the year” on July 21, and 76 pages of “BIPV’s development space / business model and competition pattern” on August 10, August 23 green power operation 37 pages of in-depth “the cost of solar energy tends to decrease or improves the operating profit, and China power construction has an integrated advantage”.

(1) New energy infrastructure: it was first proposed that 2022 will be a big year for new energy power construction, and new energy infrastructure such as BIPV will be promoted.

Industry perspective review: from November 2021 to now, Han Qicheng’s team of Guojun construction has held 158 teleconferences and 179 reports (41 of more than 20 pages).

(2) On November 28, 2021, it was proposed that “infrastructure now welcomes the opportunity to increase positions, and it is expected that the macro policy will be more positive”.

(2) Stable growth infrastructure: the first to propose the establishment of the bottom of infrastructure and the most determined to be bullish (158 teleconferences / 144 reports) (1) since November 2021, the market has been the earliest and most determined to recommend stable growth construction market (138 reports and 139 teleconferences in total).

has increased by 84%, Shandong Road and Bridge Co., Ltd.

On June 2, the Ministry of finance made efforts to support double carbon, and central state-owned enterprises in new infrastructure assisted the development of new energy.

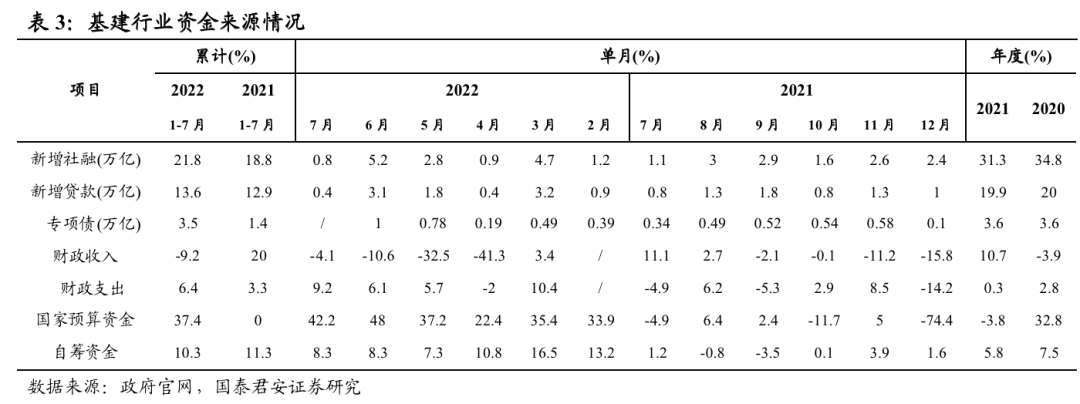

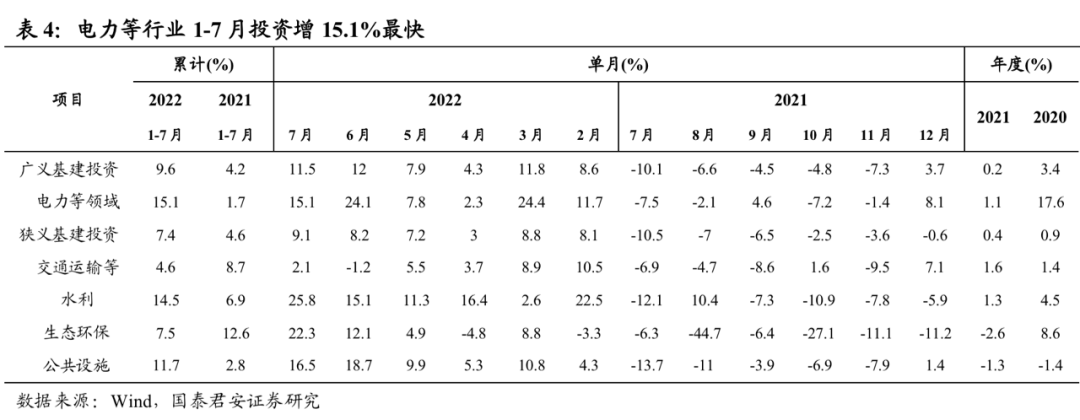

(3) On August 7, 2022, the central bank focused on supporting infrastructure, and industrial carbon peaked to support photovoltaic + energy storage; on August 16, the infrastructure investment accelerated by 9.1%, and the economic downturn policy still needs to be increased; on August 28, the steady growth policy was further increased, and the expected return on green power operations needs to be reassessed; on September 1, the infrastructure established the bottom, and the steady growth policy exceeded expectations catalyzed the return of the market.

(3) Real estate chain (8 company teleconferences / 9 company reports) the biggest increase in April July 2022: zhite new materials increased by 102%, Shenzhen Ruijie increased by 47%.

The economic recovery was lower than expected, and the state’s policy of further promoting incremental and continuous steady growth exceeded expectations.

(4) From November 21 to May 22, the biggest rise and fall was in the Shanghai Stock Exchange Index, which fell by 14.1%, the construction index, which rose by 4.72%, and ranked third in the whole industry.

On March 29, 2022, 56 pages of infrastructure central enterprises in-depth” resumption of five stable growth, accelerated performance of central enterprises, and historical bottom of valuation “, On June 29, 53 pages of in-depth “the valuation of infrastructure central enterprises does not reflect the elasticity and sustainability of performance exceeding expectations”.

(2) The State Council has deployed 19 successive policy measures of the package policy of stabilizing the economy..

has increased by 125%, Sichuan Road and Bridge Co., Ltd.

New energy infrastructure leading companies (43 company teleconferences / 47 company reports) Hangzhou Xiaogang steel structure increased by 63%, Jianghe group increased by 95%, Yongfu shares increased by 116%, Huadian heavy industry increased by 36%, China chemical industry increased by 26%, and Dongzhu ecology increased by 39%.

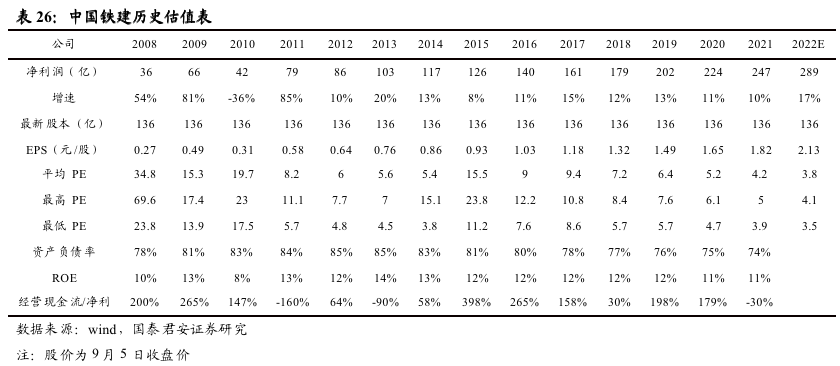

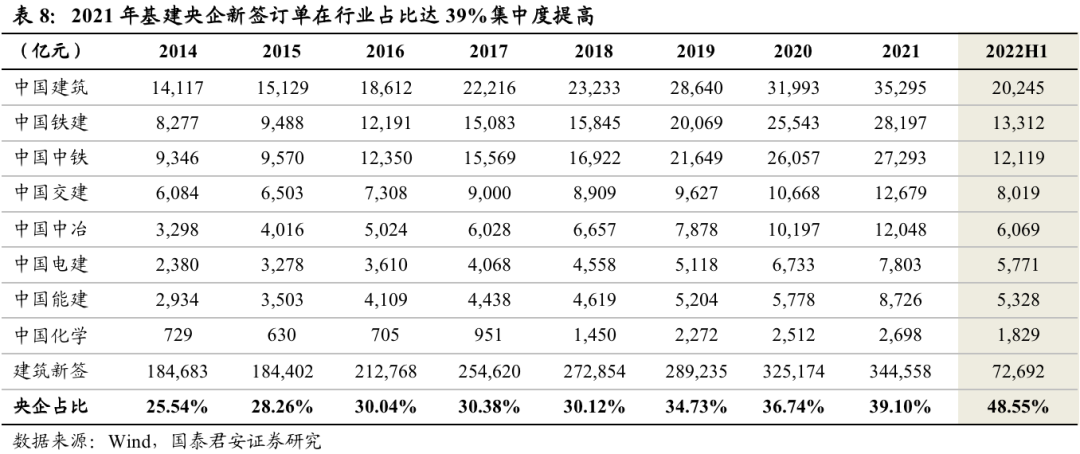

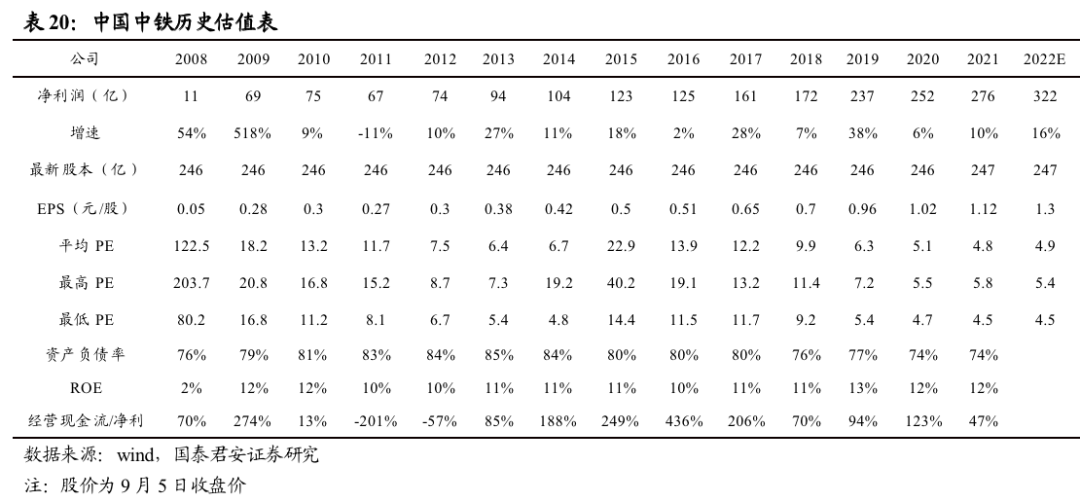

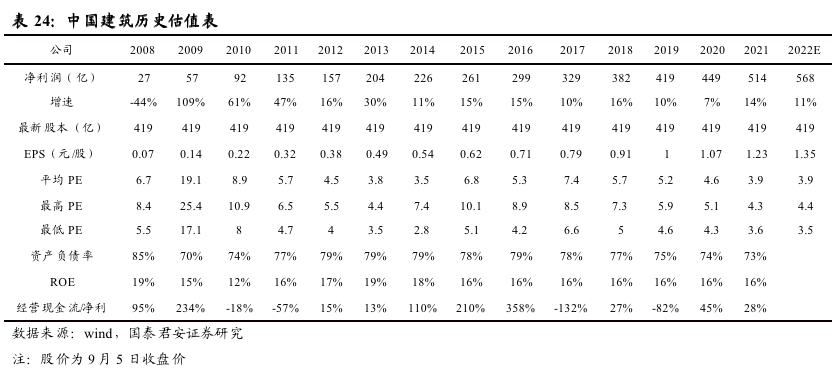

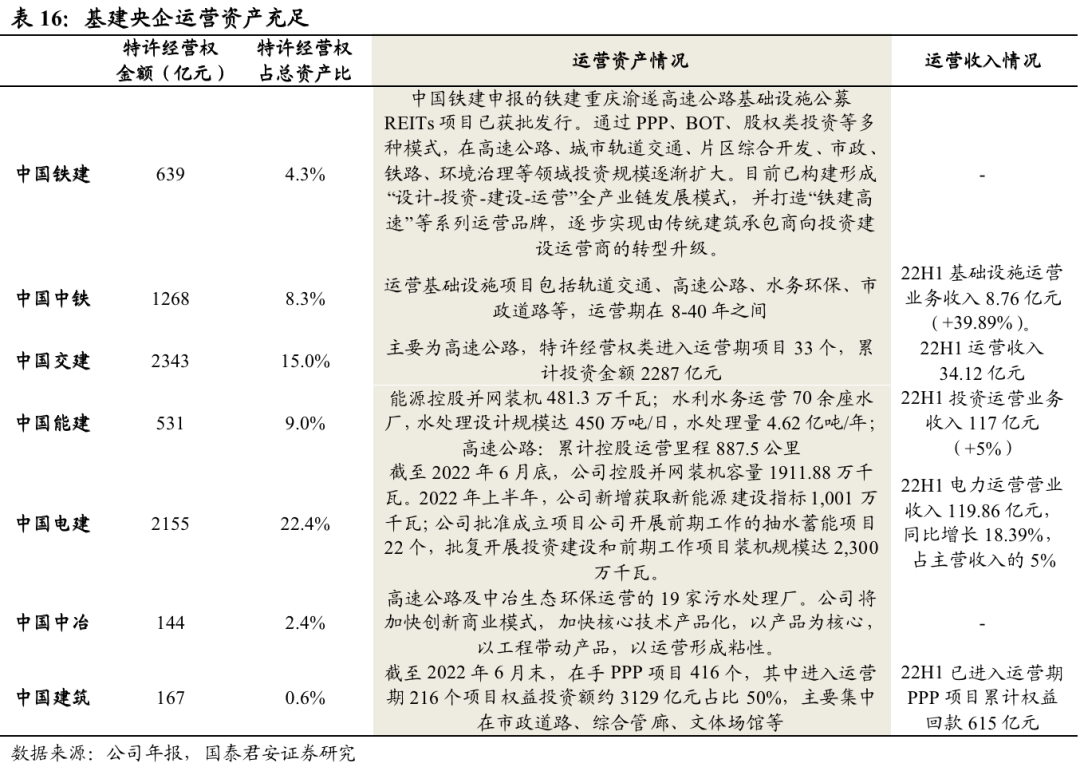

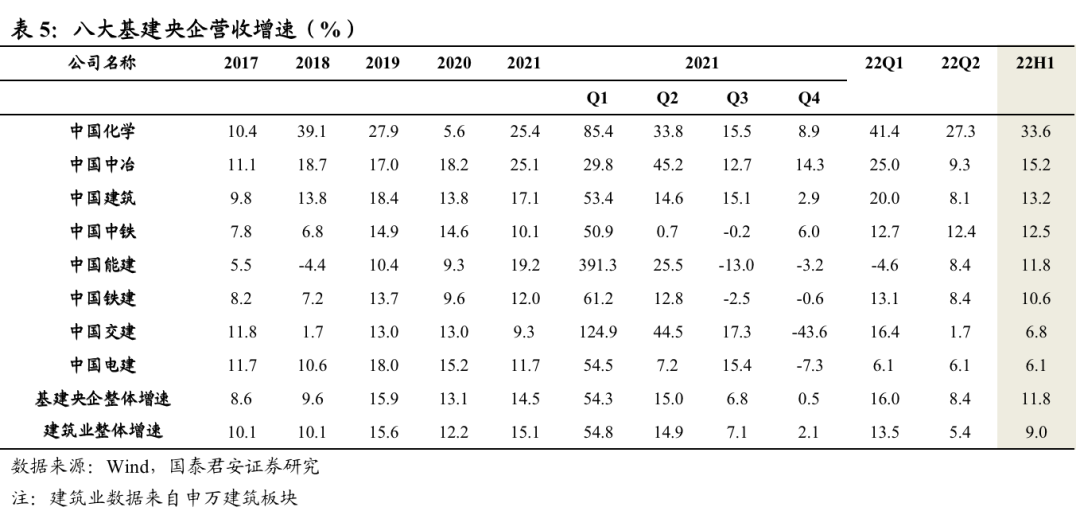

First, central enterprises (36 company teleconferences / 52 company reports) CSCEC rose by 39%, China Railway Group by 40%, China Communications Construction by 63%, PowerChina by 64%, China Railway Construction by 24%, China energy construction by 46%, and China nuclear construction by 37%.

has increased by 97%, Guangdong hydropower Co., Ltd.

The three unexpected changes in macro / industry / company restart the market of infrastructure central enterprises.

Abstract 1.

From November to December, the market held 22 meetings at the beginning of the bottom jump, the earliest opportunity for improvement and the most determined to be bullish.

1) On November 7, 2021, the carbon peak plan for energy and power may be released, and 2022 is the new energy power construction year.

On December 10, the 88 page annual strategy report “green power leads new energy infrastructure, hydrogen energy accelerates carbon neutral technology transformation” first proposed that 2022 is a big year for new energy power construction, and five new infrastructure projects such as wind, water, nuclear / BIPV / power grid / green transportation / carbon sink / metaverse were first promoted.

(4) The biggest increase in this range since May: the Shanghai Stock Exchange Index rose by 7.69%, the construction index rose by 3.02%, and the industry ranked 29th.

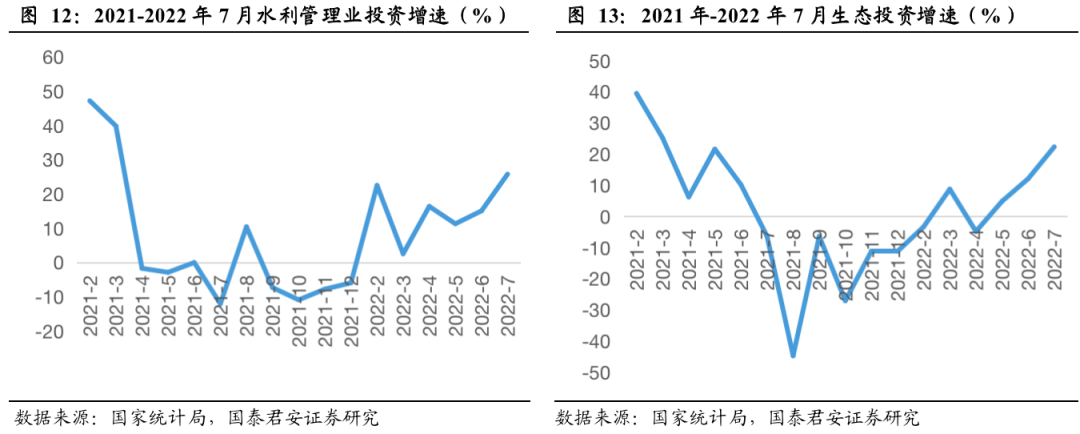

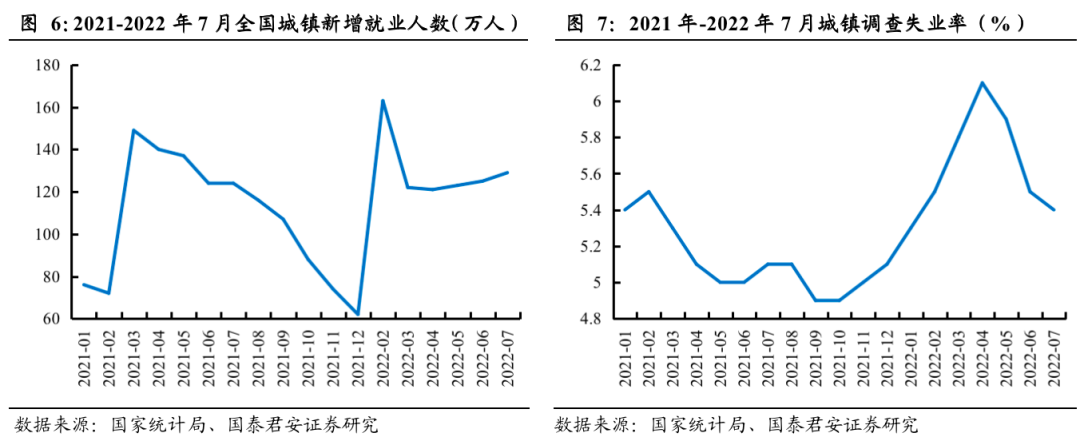

(1) In August, the comprehensive PMI fell by 0.8 percentage points from 51.7%, indicating that the overall production and operation activities of enterprises continued to recover, but the expansion strength was weakened.

Third, the design company (11 company teleconferences / 10 company reports) Huashe group increased by 60%, and the general design institute increased by 56%.

Second, local state-owned enterprises (15 company teleconferences / 11 company reports) Anhui Construction Engineering Group Co., Ltd.

has increased by 36%, and tunnel shares have increased by 19%.

On June 6, the renewable energy plan was issued, recommending EPC and operation leaders of energy such as PowerChina, On June 22, new installed capacity such as moonlight volt was accelerated in May, and new energy infrastructure such as PowerChina was recommended; on June 28, the policy added BIPV was booming, and heterojunction battery Hangxiao steel structure / PowerChina was recommended; on July 15, the policy added BIPV was driving energy storage, and PowerChina / Hangxiao steel structure / Yongfu shares were to be revalued.

On December 5, it was confirmed that the bottom will open a new round of rise, and the new infrastructure based on new energy and power will be the first to reach the peak of carbon “.

(2) On May 24, a series of reports on new energy infrastructure were launched, including the acceleration of new installed capacity in April, and the 121% increase in new contracts signed by PowerChina in April, which mainly promoted new energy power such as BIPV.

The business activity index of the construction industry was 56.5%, 2.7 percentage points lower than that of the previous month, still in a relatively high prosperity range, and the production activities of the construction industry continued to expand.

Introduction: Guojun construction Han Qicheng / man Jingya / Guo Haoran: I recommend new energy China Power Construction / infrastructure China Railway / REITs China Communications Construction / Real Estate China Construction / energy power China energy construction / China Railway Construction / China chemical / China MCC.