construction projects before April 30, 2016), cleaning contractors and projects supplied by Party A (among them, simple tax calculation method shall be used for special supply of Party A).

Business scope: land value-added tax liquidation, final settlement and payment of enterprise income tax, identification of high-tech enterprises and other authentication businesses; Professional financial and tax consultant; Fiscal and tax consultation; Tax review; Tax planning; Other tax related businesses, etc.

The cross checking relationship between the two tables: 1.

Generally speaking, simple tax calculation method can be selected for old projects (i.e.

Choose simple tax calculation method.

Click the “blue word” above to follow us! Many financial personnel are confused about the difference between “differential taxation” and “differential Invoicing”, especially when simple tax calculation and differential taxation coexist in the construction industry, they are confused about the calculation, invoicing and accounting treatment of value-added tax.

Source: originally released by the construction finance and taxation circle, author: Chang Zeyu, transferred from the construction finance and taxation home.

Advance payment of value-added tax if the provision of construction services requires advance payment of value-added tax, the total subcontracting difference shall be taken as the basis of advance payment of tax: general tax calculation method: tax payable in advance = (all price and extra price expenses – subcontracting payment paid) / 1.09 × 2% simple tax calculation method: tax payable in advance = (all price and extra price expenses – subcontracting paid) / 1.03 × 3%2.

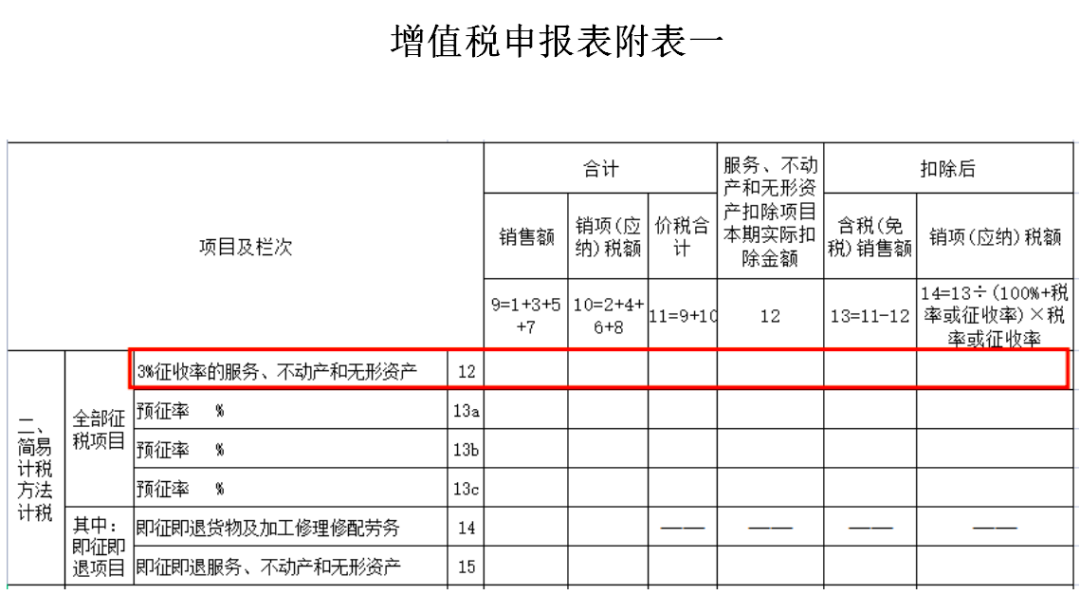

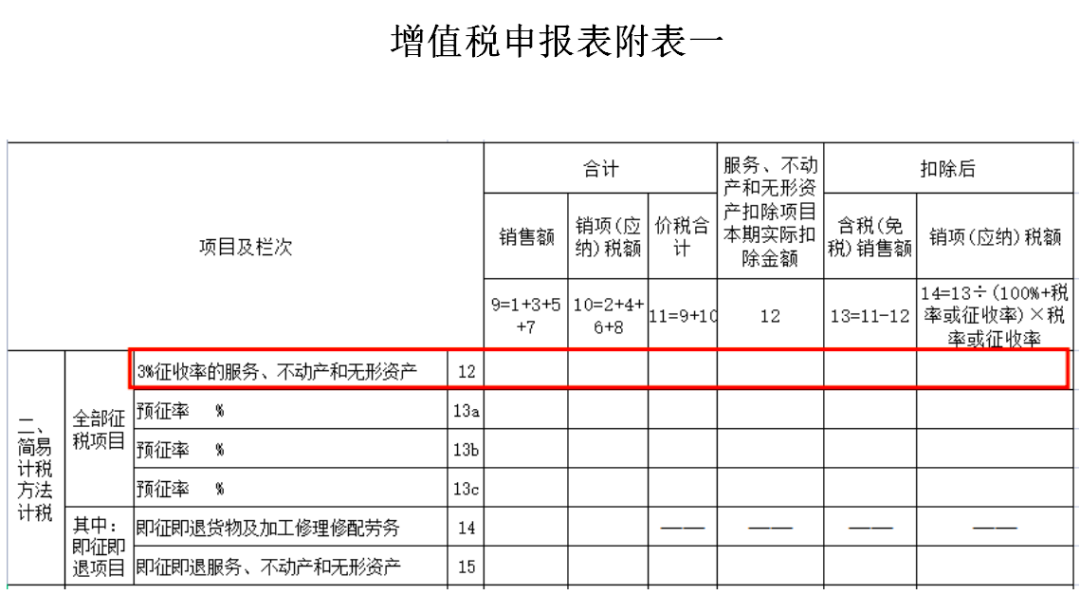

“Actual deduction amount of services, real estate and intangible assets in the current period” in schedule I corresponds to “actual deduction amount in the current period” in schedule III.

If the construction industry chooses simple tax calculation and meets the difference tax, the construction party needs to provide the owner with a full invoice in the way of full invoice and difference tax, and the general contractor needs to collect a full invoice from the subcontractor.

(1) General taxpayers choose or apply the simple tax calculation method, and the taxable amount = (total price and extra price expenses – subcontracting payment) / 1.03 × 3% (2) taxable amount of construction services provided by small-scale taxpayers = (total price and extra price expenses – subcontracting paid) / 1.03 × 3% note: according to the Announcement No.

Therefore, according to the daily Q & A questions, the author summarizes the problems that financial personnel often have a headache when adopting differential taxation under simple taxation: Question 1: under what circumstances can the construction industry adopt differential taxation? A: under the value-added tax system, the construction industry will involve the problem of differential taxation only when the value-added tax is paid in advance and the tax is calculated simply.

Question 2: is it possible to make a difference invoice when the construction industry makes a difference tax? A: No.

The “total price and tax” in schedule I corresponds to the “total price and tax (tax-free sales) of services, real estate and intangible assets in this period” in schedule III; 2.

Question 4: how to declare value-added tax when the construction industry is simply taxed and the difference is taxed? A: because the construction industry simply calculates taxes and issues full invoices when levying differential taxes, it is necessary to use the value-added tax return (attached table 1 and attached table 3) for adjustment when declaring value-added tax.

Headquarters address: 1209, Guofang office building, Baiyin District, Baiyin City contact information: 0943822533318609431696 Lanzhou Branch Address: 723, unit 1, poly ideal city G1 contact information: 13679465606 honest and trustworthy, determined to innovate, diligent and responsible, keep improving click on the blue word / pay attention to us..

Scope of joint venture: audit of annual accounting statements; Audit of assets and capital verification, liquidation and restructuring of enterprises; Economic responsibility audit and leaving office audit; Special audit for the recognition of high-tech enterprises; Audit of economic cases; Internal control assurance business; Financial audit of final accounts of capital construction completion, special audit of projects under construction, etc.

The construction company receives the subcontract invoice: Debit: taxes payable on engineering construction – value added tax payable – simple tax calculation loan: accounts payable / bank deposit essentially pays taxes according to the difference between taxes payable – taxes payable – simple tax calculation.

15 of the Ministry of Finance and the State Administration of Taxation in 2022, from April 1, 2022 to December 31, 2022, if small-scale taxpayers provide construction services in other places, the advance payment of value-added tax shall be suspended.

Question 3: how to deal with the financial affairs of a construction company that is easy to calculate tax and complies with the differential tax at the same time? Answer: when the construction company makes an invoice to the owner: Debit: bank deposit / accounts receivable loan: taxes payable on main business income – value added tax payable – simple tax calculation.

1.